Your 2023 Second Quarter IFTA Report is Due Now!

How to Generate Your Quarterly IFTA Tax Report

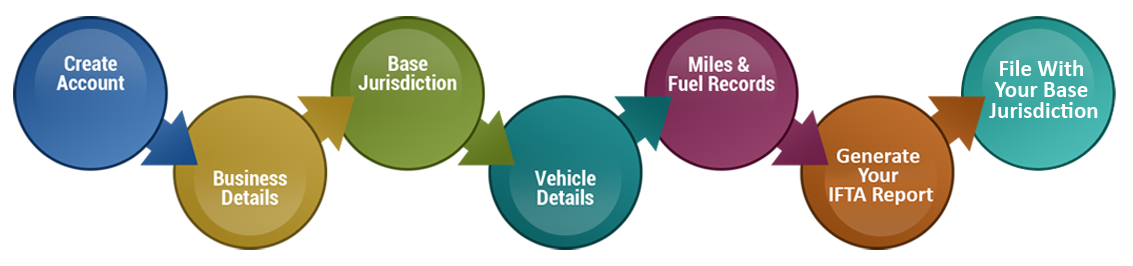

ExpressIFTA is the quickest and most convenient way to keep track of your IFTA fuel tax mileage and fuel records. Simply follow the steps to generate your IFTA report.

- Create Account

- Business Details

- Base Jurisdiction

- Vehicle Details

- Miles & Fuel Records

- Generate your IFTA Report

- File With Your Base Jurisdiction

Create Account

ExpressIFTA is completely web-based so you will need a username and password to access your account and update your IFTA tax report.

Your email will be your username and you will create your own password. Complete the registration process by entering your contact information, including your name, phone number, and primary language (ExpressIFTA is available in English and Spanish).

Don't forget to select the Tax Professional (Paid Preparer) option if you are a CPA, and to receive a discount every time you generate an IFTA fuel tax report with ExpressIFTA.

Business Details

Adding your business information is fast and easy. Simply enter your basic business details i.e. (EIN, Business Name, Mailing Address, etc.) in all required fields, which marked by an asterisk (*). This information will be on your IFTA report when you generate and print your return. This is how your base jurisdiction will match your IFTA fuel tax return with your file in their database.

You only have to enter this information when you create your ExpressIFTA account, after that your business information will be automatically saved. You can easily edit it anytime under the "Business" tab.

Base Jurisdiction

Selecting your Base Jurisdiction (State/Province) is important because each state/province has different International Fuel Tax Agreement compliance requirements. When you generate and print your IFTA tax report our system will generate a return that matches your base jurisdiction's regulations and provide you with the necessary schedules.

Don't forget to include your IFTA Account Number so your Base Jurisdiction can match your return to your IFTA account. If you do not have an IFTA Account Number you will need to contact your base jurisdiction directly to apply for an IFTA license and receive your IFTA Account Number. The contact information for your base jurisdiction is available "IFTA" tab at ExpressIFTA.com.

Vehicle Details

Our system supports every fuel type you can think of including diesel, propane, ethanol, biodiesel, and more.

You can also add detailed vehicle information, including the license plate number, make, model, year, etc.

If you file for multiple drivers or have multiple drivers in your fleet you can also add their names and CDL number to our system so you can easily track them individually for accurate IFTA fuel tax reports. This makes reporting on multiple drivers and vehicles for the International Fuel Tax Agreement quick and simple.

Miles & Fuel Records

Easily enter your distance and fuel records at your own pace. First select the quarter, vehicle, and driver you want to begin an IFTA report for. Next, choose which way you want to record your mileage and fuel records. You can enter your records into the system via Trip Sheets, Quick Entries, or GPS Upload. Everything you enter into the system is automatically saved so you can add your mileage and fuel records on a daily, weekly, monthly, or quarterly basis to update your IFTA tax report at any time.

-

Trip Data Entry: You can enter trip specific details, including fuel purchases and distances you travel for a specific trip using our Trip Sheets option. Once the IFTA quarter has ended and you are ready to create your IFTA report all of your trip logs will already be prepared and ready to instantly generate your IFTA return.

-

Quick Entries: You can also use our Quick Entries option to enter your IFTA fuel tax details for the entire quarter. You can choose to do this based on your odometer readings or distance records.

- GPS Upload: If you have a GPS system that tracks your IFTA details this is the easiest way to generate your IFTA report. Simply upload your GPS report to our system and ExpressIFTA will calculate your IFTA tax balance.

Generate your IFTA Report

Our system automatically calculates the MPG for your vehicle(s). Before generating your IFTA fuel tax report, you can select the appropriate MPG range for your vehicle and ExpressIFTA will catch if the data you entered falls out of that range at any time throughout the quarter to find any data entry errors that need to be corrected.

Once any errors are corrected, ExpressIFTA will calculate any penalties, interest, or credits/refunds, based on your Base Jurisdiction's instructions. You always have the ability to come back and run IFTA tax and IRP Reports on any specific quarter for business-related records and auditing purposes.

Visit https://www.trucklogics.com/ifta-reporting-requirements/ to know more about your IFTA Reporting.

File With Your Base Jurisdiction

Not all states have the same requirements for the International Fuel Tax Agreement. Some base jurisdictions require you to submit your IFTA fuel tax return in a PDF format, while others require you to complete your IFTA tax return online. That's why ExpressIFTA makes it easy to complete your IFTA return no matter which base jurisdiction is yours by providing a PDF format and online worksheets.

You can track your IFTA totals with an offline PDF format to print and submit to your base jurisdiction to complete your return. You can also use our online worksheets to track your distance and fuel totals online. Our IFTA worksheets can be used to easily complete your IFTA fuel tax return online. Learn about your state's IFTA fuel tax requirements here.