IFTA Introduction

- IFTA allows you to travel in all participating member jurisdictions with a single fuel tax license.

- Filing an IFTA quarterly return documents your operations in each IFTA member jurisdiction.

- By filing an IFTA quarterly return companies undergo fewer audits which are generally performed by tax examiners form their representing jurisdictions.

Who is required to file an IFTA quarterly tax return?

Any "qualified motor vehicle" that travels between two or more member jurisdictions are required by law to have an IFTA license and decals on their vehicles issued to them by their base state/jurisdiction. IFTA member Jurisdictions include the 48 continuous states and also 10 participating Canadian provinces.

Your IFTA quarterly tax return must be filed in the member jurisdiction which your IFTA license was assigned.

Your vehicle is considered a "Qualified Motor Vehicle" if it is designed, maintained, and/or used to transport people or property and:

- Has two axles and gross vehicle weight that exceeds 26,000 pounds or

- Has two axles and a registered weight that exceeds 26,000 pounds or

- Has three or more axles or

- Has a combination weight that exceeds 26,000 pounds.

The only vehicles exempt from reporting IFTA are recreational vehicles.

Your "Base Jurisdiction" is the member jurisdiction/state where:

- Your qualified motor vehicle(s) are registered;

- Operational control and records of the licensee’s qualified motor vehicle(s) are maintained and available for auditing purposes; and

- Some mileage is accrued by qualified motor vehicles within a fleet of vehicles that travel through that jurisdiction.

Learn more about IFTA state Fuel Tax

To simplify your IFTA Reporting, Generate IFTA Report with TruckLogics, #1 Trucking Management Software

What do I need to file my IFTA quarterly tax return?

To file an IFTA quarterly tax return you will need:

- The total miles, taxable and nontaxable, traveled by the IFTA licensee’s qualified motor vehicle(s) in all jurisdictions/states, regardless if they participate in IFTA, which includes all trip permit miles;

- The total gallons or liters of fuel that is consumed by a qualifying motor vehicle, including taxable and nontaxable, in all jurisdictions/state whether they participate in IFTA or not;

- The total miles and total taxable miles traveled in each member jurisdiction;

- The total taxable gallons consumed in each member jurisdiction;

- The tax-paid gallons/liters that are purchased in each member jurisdiction; and

- The current tax rates for each member jurisdiction.

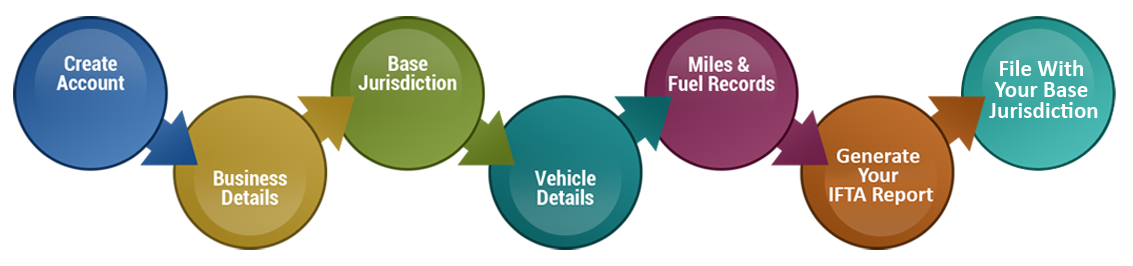

Steps to generate your IFTA quarterly return using ExpressIFTA

- Create Account

- Business Details

- Base Jurisdiction

- Vehicle Details

- Miles & Fuel Records

- Generate IFTA Returns

HELP VIDEO: ExpressIFTA Overview

When am I required to file my IFTA quarterly return?

Use the table below to find your IFTA Filing dates for 2023

| Quarter Periods | IFTA Quarterly Tax Return Due Dates* | Due Dates |

|---|---|---|

| 1st Quarter | January - March | April 30 |

| 2nd Quarter | April - June | July 31 |

| 3rd Quarter | July - September | October 31 |

| 4th Quarter | October - December | January 31 |